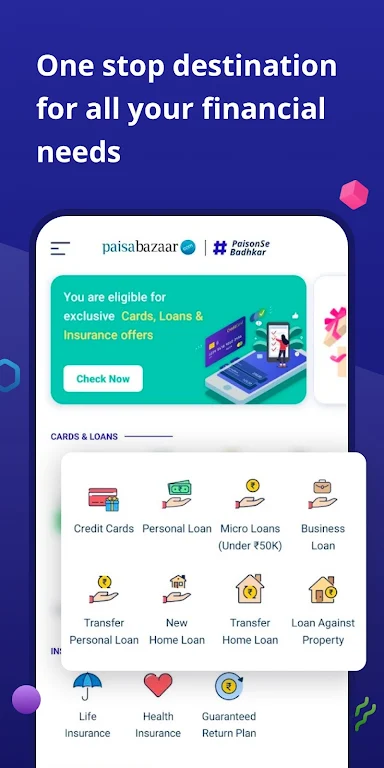

Are you ready to take charge of your financial well-being? The CreditScore, CreditCard, Loans App is your ultimate tool for achieving financial freedom. By downloading the app, you gain access to a comprehensive free credit report from multiple credit bureaus, ensuring you have the most up-to-date credit scores. This empowers you to make informed decisions. Whether you're on the hunt for a new credit card, a personal loan, or even dreaming of a home loan, the app offers a diverse selection from India's top banks and financial institutions. With personalized loan and credit card offers, instant micro-loans, and expert assistance, managing your finances becomes a breeze. Join the ranks of over 22 million satisfied users and embark on your journey towards financial empowerment today.

Features of CreditScore, CreditCard, Loans:

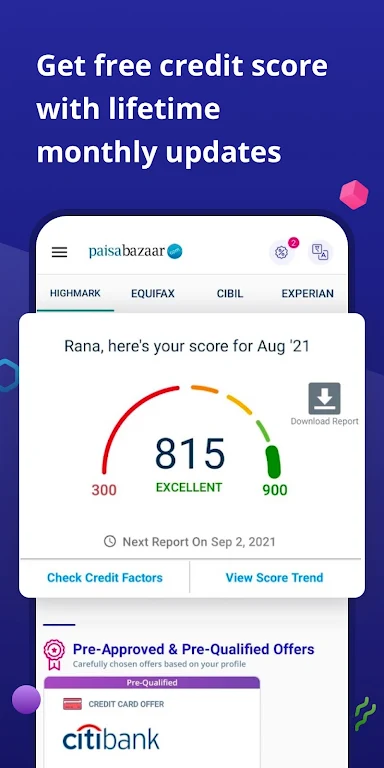

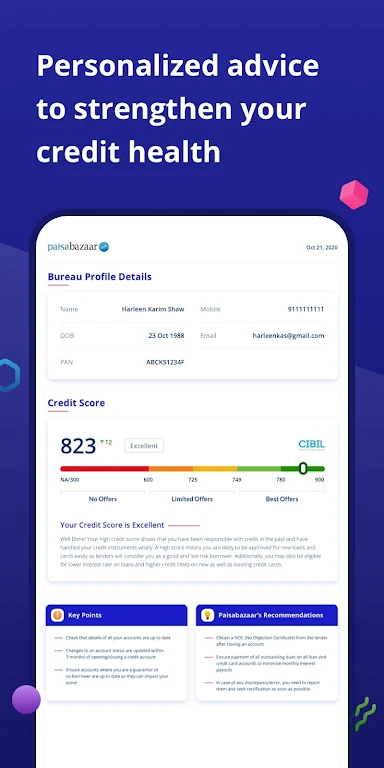

Free Credit Report: Access your credit report at no cost from multiple credit bureaus, including CIBIL, to stay informed about your credit status.

Wide Range of Products: Select from over 60 partners, offering more than 35 credit cards and instant micro-loans, ensuring you find the perfect fit for your needs.

Personalized Offers: Benefit from pre-approved loan and credit card offers tailored specifically to you, with the convenience of instant disbursals.

Easy Comparison: Effortlessly compare, choose, and apply for the most suitable loan or card with the help of expert assistance, all within the digital platform.

Business and Home Loan Options: Discover a variety of business loan offers and home loans, featuring the lowest interest rates available.

Secure Platform: Keep track of your debit and credit balances securely in one convenient place, safeguarding your financial health.

FAQs:

What is the repayment tenure for Personal Loans?

- Personal Loans typically come with repayment tenures that range from 3 months to 5 years, offering flexibility based on your financial situation.

How is the APR calculated for a Personal Loan?

- The Annual Percentage Rate (APR) for a personal loan can vary between 9% to 35%, depending on your individual credit profile and the lender's policies.

What are the total costs involved in taking out a personal loan?

- The total cost of a personal loan encompasses the principal amount, interest charges, loan processing fees, documentation charges, and amortization schedule charges, ensuring you understand all aspects of the loan.

Conclusion:

With its extensive range of products, user-friendly comparison tools, and robust security features, CreditScore, CreditCard, Loans stands as your go-to financial companion for life. Seize control of your finances and access the best loan and credit card offers from India's leading banks and financial institutions through a seamless digital experience. Make a smart move for your financial future by downloading the app today.

Tags : Other